I am all about earning a crust in the online world, or E-Commerce as it is popularly called. I hope you find something in these pages of use to you.

Today I want to look at…

- The Best Payment Processors for E-Commerce in South America.

- South America.

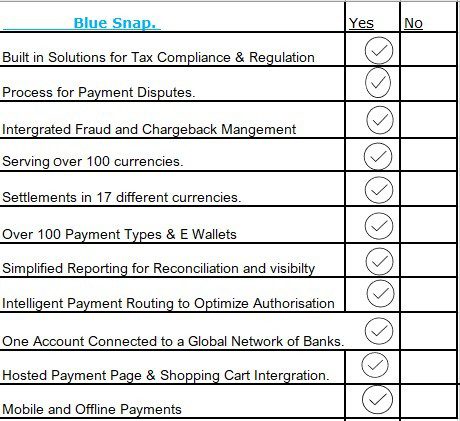

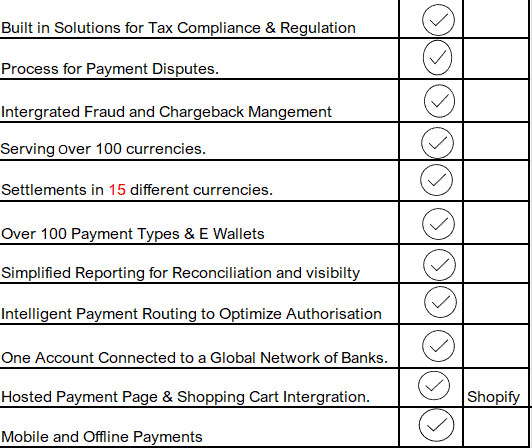

- Blue Snap. The All in one Payment Platform.

- The Benefits of Having One Payment Processor

- Some Benefits of Blue Snap include

- A brief look at some features.

- Shopper Support Fees and Chargers.

- dlocal. 360 Payments Platform.

- Features and Benefits of dlocal

- Shopper Support Fees and Charges.

- Conclusion

- Languages

The Best Payment Processors for E-Commerce in South America.

With everything that is going on in the world, I want to turn my attention to South America. In this post I am reviewing possibly the 2 best payment processors for e-commerce in South America.

The two I will review are not the only ones who service this market, but they are probably the most advanced payment processing platforms in the emerging markets sphere.

WorldPay has been undergoing a transformation over the past 12 months, and these take overs and management changes might be of interest if your researching Payment Processors for South America.

South America.

It is a huge neglected market. There are some reasons for this, but none are insurmountable. Take the time to line up your ducks, and a successful business awaits.

One must have to operate in South America, is to have a payment processor that process’s payments outside of the of the established online e-comm sphere of the USA, Europe, Parts of Asia and the Pacific.

PayPal is still important, but there are others that operate where PayPal doesn’t.

If they integrate with Pay Pal so much the better. Lets see which of these is most suitable for helping unlock a successful e-comm store in Sth America.

The ones I will look at today are..

Blue Snap and Dlocal.

Blue Snap. The All in one Payment Platform.

Before I start with Blue Snap though, there is a substantial nationalist feeling in certain countries against China over this Corona virus pandemic.

In the United States, some parts of Asia and the Pacific, parts of Europe and a few others. There is a high percentage of people who say their countries should be less reliant on buying from “the worlds factory.”

Is this the end of the road for E-Commerce and the drop ship model?

The drop ship model is well established and my contrarian view is, that it is ripe for expansion. So I would say No.

Central and South America are also providers of products that have appeal in other parts of the world.

This link at the end will explain a little more for you. It is a little away from the topic, but it gives some idea of the dynamics at play outside of the media and political commentary. The link here.

The Benefits of Having One Payment Processor

Back to the story.

Blue Snap services 100 different currencies, throughout Latin America, North America and Europe and Asia.

BlueSnap mission is to “…offer your customers a seamless payment experience, responsive support and robust global payment capabilities, like SEPA Direct Debit for Europe, ACH for the US and all card types.”

The dynamics of South America do not support a single currency like the Euro in Europe. Politically it is just to unstable, and added to that each has it own currency. Well sort of, Panama uses the $US dollar, next door Colombia has a Peso and Brazil has the Real

In saying that…

My experience, is if you can sell in Europe, you can sell in South America. Forget the politics, it’s the people you are working with.

One of the reasons I rate these two payment processors top of my list, is they have done the work to uncover the psyche of the population.

Of course there is more detail contained on their websites.

But this overview, written in early August (5 months into the ‘Rona” lockdown), in Colombia, this has opened my eyes to a couple of things not generally known or understood about this part of the world.

One of them being Colombia with a population of about 50 million, nearly 50% are young ( below 35years ), and most have smart phones with internet connections.

Some Benefits of Blue Snap include

- Reduced costs related to pass-through tax charges

- Increased sales (up to 35%) and payment conversions (up to 30%)

- Reduced checkout friction by offering local currencies and payment methods.

- Use Blue Snaps SKDs to create a mobile-friendly checkout experience and offer multiple E-Wallets to capture and delight more mobile shoppers.

- Seamless, one-click checkout and stored payment information for returning shoppers.

- Blue Snap removes some traditional barriers to international sales, like high taxes from settling into an international account, and the requirement to be a local legal entity.

A brief look at some features.

Personalized Checkout

Blue Snap has developed a platform that not only expands the concept of E-Commerce in the online world, but it allows people to interact in their own language and currencies.

BlueSnap customers are responsible for collecting taxes themselves except, if you are using BlueSnap Merchant of Record (Reseller) model.

Shopper Support Fees and Chargers.

Any sort of E-Comm website needs communication with its customers.

Blue Snap is multi lingual. So it ticks another box.

Cross border fees can be tricky and will eat into profits if not properly investigated. As the merchant, you might be supplying items from multiple countries.

Depending on the country you supply the item from as to what cross border fee you will pay. My last two cross border fees ( just from 2 Visa’s transactions), were $3.36 and $6.57. Both on the same day for amounts less than $500.00.

Forget about profiting from them. Check the charges each month and try to average your cost.

For Blue Snaps Complete capability go to the link below.

dlocal. 360 Payments Platform.

A United Kingdom Company and chosen by Amazon in January this year (2020), to kick off its localized payments in Chile.

Dlocal Corp. LLP. acts as an agent of e-commerce merchants based in the USA, and collects payments from end users based in emerging markets, on behalf of the merchants.

Originally called “Astropay”, there is a lot to like about this Fintech company founded in Uruguay

With 2 of its world wide offices in South America, dlocal has good research on payment trends in the growth markets of Latin America, North Africa, and the Middle East.

dlocal casts a wide net, but it has done excellent research, and partnered with top tier companies. Check out the Data Here

Features and Benefits of dlocal

Shopper Support Fees and Charges.

There is a minimum monthly fee: dLocal collects a processing fee per transaction which varies depending the payment method and country.

If the total fees collected across all payment methods and countries is below $150 usd in a calendar month, dLocal will retain the difference between the fees collected and $150 usd for that month.

Knowing what the minimum monthly charge will be gives a starting point to build in costs to your pricing.

Many people in South America utilize a “layby” system. That is, they pay things off in installments.

dlocal have allowed for this in their system and made it a key part of their platform for merchants to utilize.

Conclusion

Drop shipping to South America in its purest form is not likely to work as well as combining drop shipping and having some product in stock for local consumption.

This is not to say that, if you do not live in South America it won’t work. What you need to do is be very clear on where you are based, and have your delivery options clearly shown.

First rule of selling, it is not about you.

With 5 months of lock down, isolation rules and other restrictions, South Americans have had to adapt to buying online.

Some of the data for Colombia ( for instance), with a population of 50 million nearly 50% are under 35 and 75% have a smart phone to connect to the internet. This sort of data should guide you to what sort of niche you could use that would translate to good sales.

I was actually helping two Colombian women order stuff online from a hardware store today.

They were also comparing the prices. So they are savvy shoppers, and of course when their friends ask … “Where did you get it?”… ?

Another thing that has come to my notice and that is DHL is setting up 10 more retail outlets in Colombia.

With these two payment processors I am not giving a preference or a rating. Although they have similar features and benefits, business’s have variable needs and either one or both of these payment processors will have some feature or benefit that suits some business’s but not others.

What I will say about them is…

They are looking to expand their business’s, so you should expect helpful service.

Languages

Both have their platforms set up to accept languages other than English. I didn’t mention it too much in the post but Blue Snap is integrated with Woo-Commerce, and dlocal is integrated with Shopify.

They are not the only two, if you have hosting from Wix or GoDaddy those two payment processors will integrate as well.

Hi Michael,

It is a very informative review. I didn’t know about these 2 payment processors since I’m not familiar with South America. However, thank you for sharing and I think there is a huge potential for the E-commerce industry in South America. I believe there is a bright future for these 2 payment processors due to the rapid development of E-commerce in South America.

Thank you for sharing.

All the best,

Alex